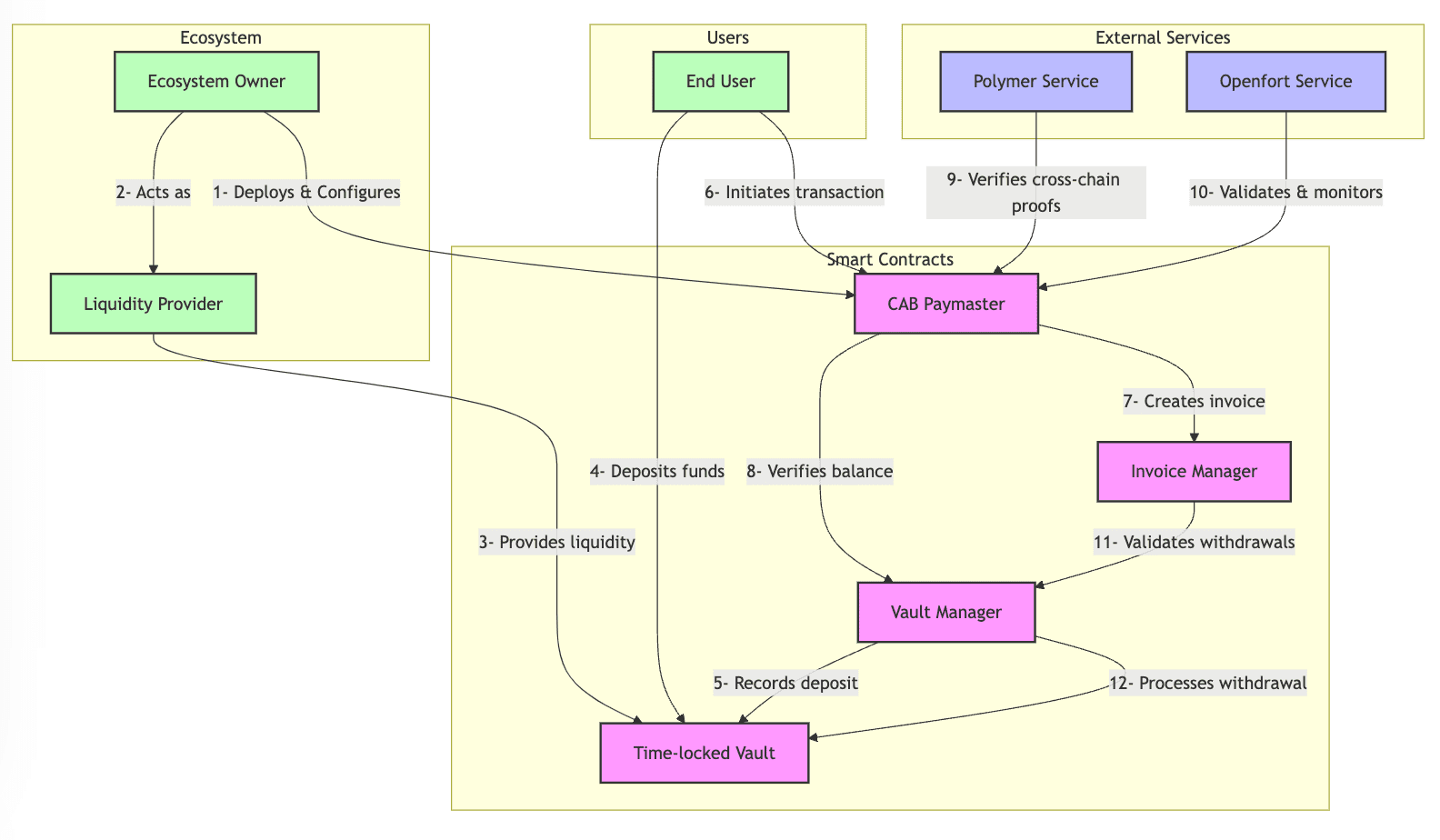

Ecosystems serve as parent entities for groups of apps operating across different blockchains. Openfort ecosystem wallets enable seamless interoperability between applications, allowing ecosystems to design their ideal, unified wallet experience. The next evolution is to consolidate user liquidity across apps, providing a single, unified balance that is instantly spendable across the ecosystem.

A significant step towards unifying liquidity across the space are cross-chain interactions. By leveraging time-locked vaults and onchain proofs, our ecosystems can now provide users with a unified balance instantly accessible across all apps within their ecosystem.

This first implementation builds on:

- MagicSpend++ with time-locked vaults to simplify cross-chain operations while ensuring security and speed. Vaults can be yield-bearing. Users deposit once to enable chain abstraction and put their money to work. Different yield strategies will come.

- Polymer's Prove API, simplifying contract development by replacing manual cross-chain messaging with a more intuitive and native approach of on-chain proofs.

Why this matters

Chain abstraction is an ambitious space with many approaches. Most rely on third parties (fillers/solvers) that will compete to front liquidity on destination chains in exchange for fees. At Openfort, we grant the ecosystem the power to become an LP for its users and only rely on external liquidity when required.

With our setup, ecosystems can deploy tailor-made 4337 chain abstraction infrastructure. They become Liquidity Providers (LPs) for their users, sharing with them the value that would otherwise have been captured by fillers/solvers.

- Intents: Allow users to express what they want to do, regardless of the underlying blockchain.

- Time-locked vaults: Assets locked in the vault serve as a guarantee for Payamasters.

- Onchain proving: Ecosystem can’t be repaid without cross-chain execution proof —zero trust assumption. The InvoiceManager contract tracks onchain repaid invoices to forbid double repayment.

This means your users can securely:

- Buy assets on one chain using liquidity from another

- Deposit any ERC20s on any chain to increase their chain abstracted balance

- Interact with apps across blockchains without friction

How it works

At the heart of our system are:

- Time-locked vaults: Securely lock user funds, ensuring they’re only used as intended. It can be yield-bearing.

- Chain abstraction paymasters: 4337 compatible paymasters which handle gas and destination chain transaction costs. Ecosystems own them. They’re approving the required ERC20s after validating the Openfort backend signature.

In practice, an ecosystem can deploy its onchain infrastructure, acting as a liquidity provider for its users. Funds locked on the origin chain are released only after transaction proof is obtained from the destination chain.

This design ensures:

- Frictionless user experience: Transactions feel as fast as same-chain operations.

- Non-custodial security: Openfort Backend authorizes transactions but cannot spend funds.

- Trust-minimized execution: Users can withdraw all their chain abstracted balance after a configurable lock period. Ecosystems can rage-quit (i.e., instantly withdraw all liquidity from their paymasters). Neither Openfort nor the Ecosystem can get refunded without the userOp execution proof verified on the source chain.

This approach makes interop simple, fast, and secure. Ecosystems can share value with users instead of solvers while ensuring liquidity is always available where needed.

What’s next?

For ecosystem: automatic liquidity rebalancing between chains with Openfort custom alerts when a Paymaster balance is lower than a programmable threshold.

For users: Put your money at work. Our chain abstraction demo is built around basic time-locked vaults, but we will deploy yield-bearing vaults with different DeFi protocols.